The death of the energy industry as we know it is imminent. The demise of electricity and the transport fuels part of oil and gas, roughly 50%, will be driven by entrepreneurs. I do not believe the energy industry will transform itself into what is ecologically desirable from within the industry. That is, resulting from regulatory or public policy changes, or from business development or intrapreneurship.

The transport fuels part of oil and gas and electricity are no longer distinct industries. Petrochemicals such as fertilizers, paints and polymers are separating out from the fuels, making the fuel segment of the industry vulnerable to competition from electric vehicles (EVs) charged using next generation renewables-centric electricity. Major industry structure dislocation is at hand in the hybrid electricity-oil industry.

The intra-industry forces within electricity and oil and gas will have a marginal impact; they will be too slow to be consequential from a business or a climate impact perspective. Entrepreneurs will literally and structurally clean-up the incumbent industries, just as COVID-19 has inadvertently reduced the air pollution in major cities. A new, synthesized industry structure will occur and IoT will hasten the epic transformation. The intermingling of the fuels industry, electricity and IoT will create significant entrepreneurial opportunities. A clustering of innovations, compressed in time and amalgamated across geographies, will lead to Schumpeterian “creative destruction.”

What drivers are at play? Microgrids as an exogenous force

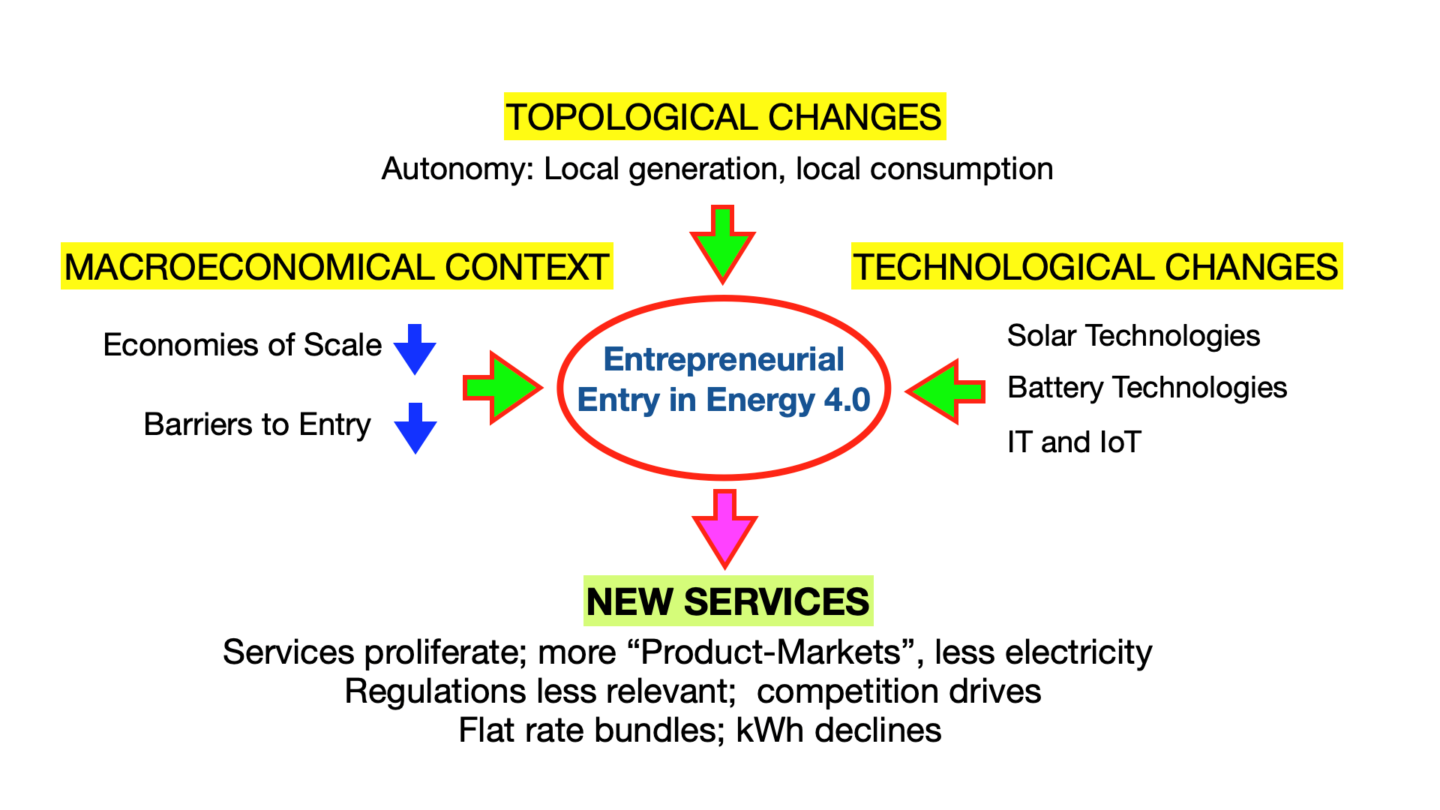

Two major macroeconomic facts, plus technological forces and topological transformations are poised to drive this change. See Figure 1.

- The barriers to entry in electricity are gone, though not in the oil and gas industry. When electricity can substitute for gasoline and diesel, substitution is analogous to reduction in entry barriers in transport fuels.

- The unit cost of electricity is now independent of scale of production. That is, GW-scale plants are no longer necessary for low unit electricity prices. Economics of large numbers will dominate.

- Decline in transmission will accompany decline in GW generation.

Microgrids representing local generation, local consumption and local autonomy are the topology of the electricity system of the future. While from the outside microgrids appearto resemble a smaller version of the grid of today, that is a misperception. The existing utilities have a hands-off, cautious relationship with microgrids. Microgrids, in fact, may be regarded as an exogenous force to the existing industry structure, ideally pursued by entrepreneurs more than by incumbents.

One corollary of this situation is that the “natural monopoly” in electricity is obsolete and, in principle, will be gone soon. With the end of natural monopoly, there will also be an end to the ponderous regulatory infrastructure dealing with “rate of return,” filings, hearings and debates. How fast will the monopoly mindset disappear? Maybe generational change hastened by legislative enablers such as “community choice aggregation” will be necessary. In any case, with numerous smaller electricity suppliers, competition eliminates most of the regulations as we have them. Some minimal regulations may be all that survives, comparable to what obtains for any normal business.

We may recall the time when elaborate regulatory processes existed in telecommunications. The advent of wireless technologies, the internet and a proliferation of customer terminals led to their decline. In a word, competition: beginning with the arrival of MCI Communications to challenge to the old AT&T monopoly in the US. Changes in the rest of the world followed.

Something analogous is likely in the energy industry. After all, every electrician, every solar installer, every facilities management group and even certain customers too are competition to the electricity providers of today.

Possibility is not reality

Even if the macro context is favorable – the absence of entry barriers, for instance – it does not follow that entrepreneurs will enter. The absence of entry barriers is a necessary, but not sufficient, condition. Opportunity must exist at the ground level, through emerging technologies, or changing use patterns, or new configurations, for example, that generates customer benefits. Figure 1 shows such changes at the macroeconomics, technology, topology and services level.

Entrepreneurs today are not too alert to the scale and magnitude of the opportunity in replacing traditional electricity. We are in a latent market from both the demand and supply side. Both entrepreneurial recognition of opportunities, and new customer demand, have yet to reach a critical mass. Customer perceptions of new benefits are not yet clear. One customer side rationale is: The electricity system works, it delivers power. Why fix something that is not broken?

The reality is that the system is alarmingly broken, at the environment and air pollution level, and has put human life on the planet at peril due to carbon dioxide emissions.

Value not units – Transformation has begun

Currently, solar hot water heaters are commonplace in hostels, in universities and housing societies. Some municipalities make them mandatory on new, and even existing, buildings. Such water heaters directly substitute for the grid-power based electric water heaters today, and kerosene or wood burning stoves from the past. The point is: Entrepreneurs deliver this service, not the electric utility.

As time goes by, entrepreneurs will also provide off-grid lighting services for common areas of campuses, for instance. If hot water and lighting is being affected now, can air-conditioning, cooking and cold storage be far behind? Entrepreneurs must think about: What attributes or values besides reduced price need to be incorporated with their offers?

Prices must be at least 20% less than grid power over several years. This price will most likely be amortized cost of capital more than the cost of fuel or supply logistics, as is the case with today’s grid power. We may expect grid power to continue to rise in cost due to rise in input costs, but renewables and batteries will only fall in price as global scale increases.

Additionally, few understand kWh as a unit. Even “unit” makes no sense going forward. Price must be tied to use or benefit; for example, heating, cooling, motion, and to simplicity such as bundles of use. Such bundles are commonplace in telecom now, per call or time of use prices are gone. Besides price: Reliability? Clean and green attributes? Speed? Safety? Power quality, say, for a hospital? Brand?

Welcome to a Brave New Energy world.

Figure 1: Reinforcing interplay among Topological and Technological Forces and the Macro-Economics Context leading to New Services

.png)